World Market for Wind Power Saw Another Record Year in 2021: 97,3 Gigawatt of New Capacity Added

World Market for Wind Power Saw Another Record Year in 2021: 97,3 Gigawatt of New Capacity Added

Total global capacity reached 840 Gigawatt

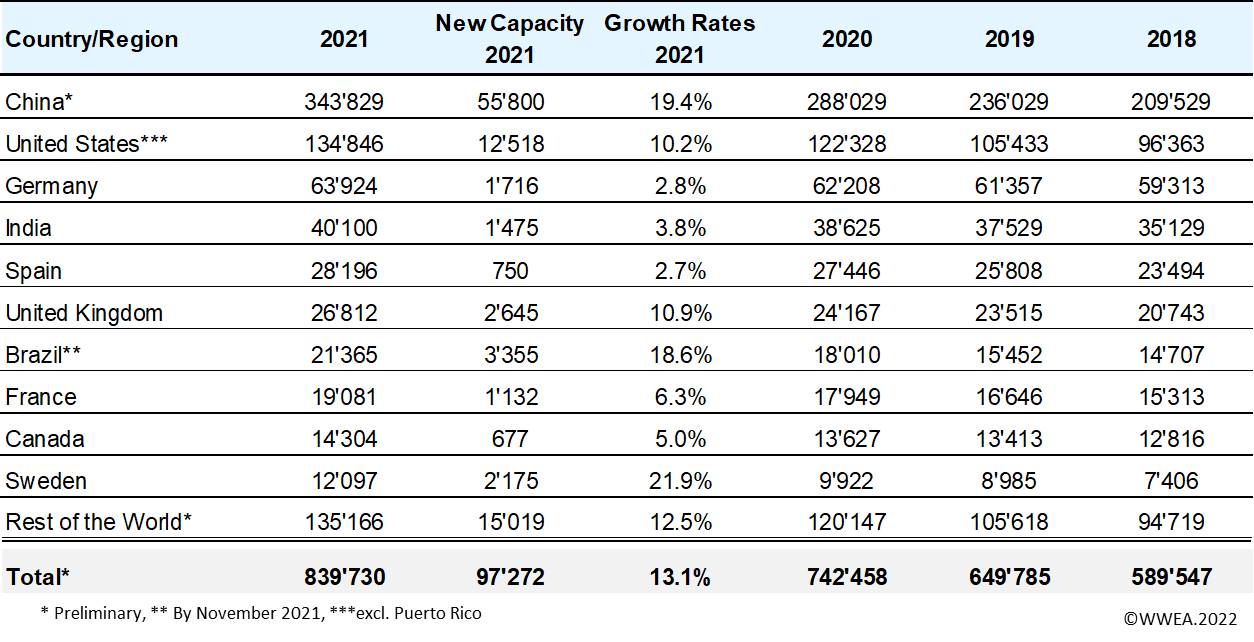

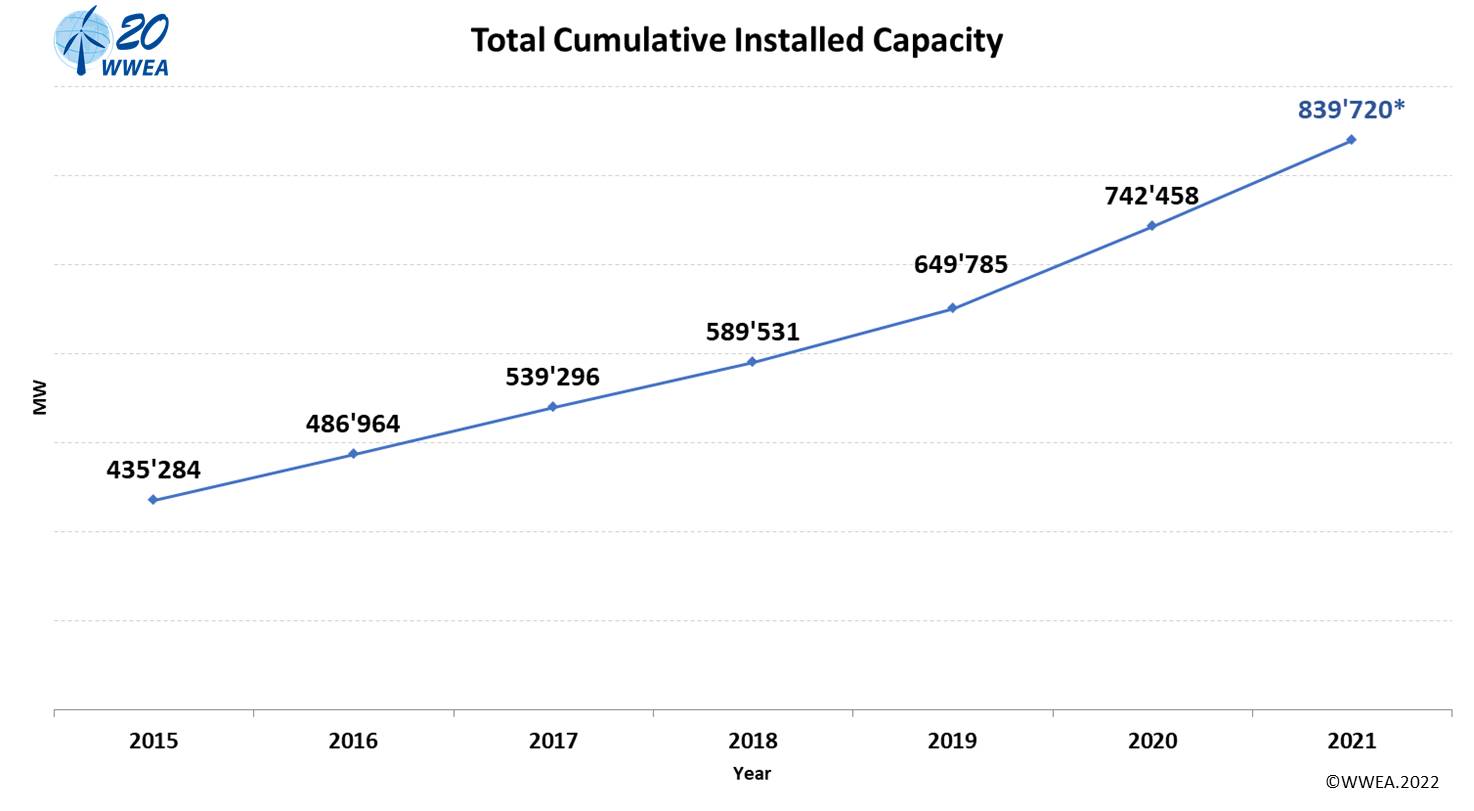

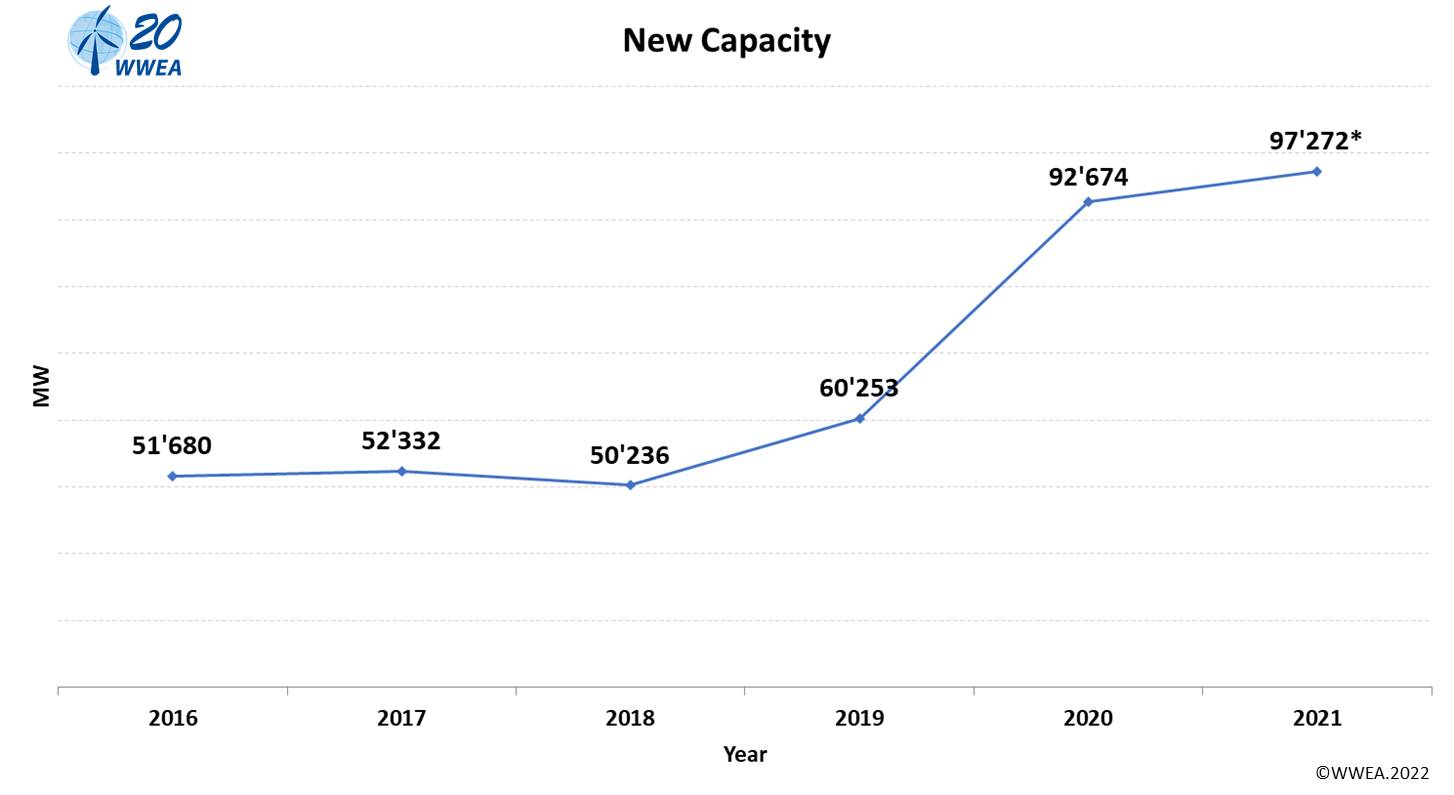

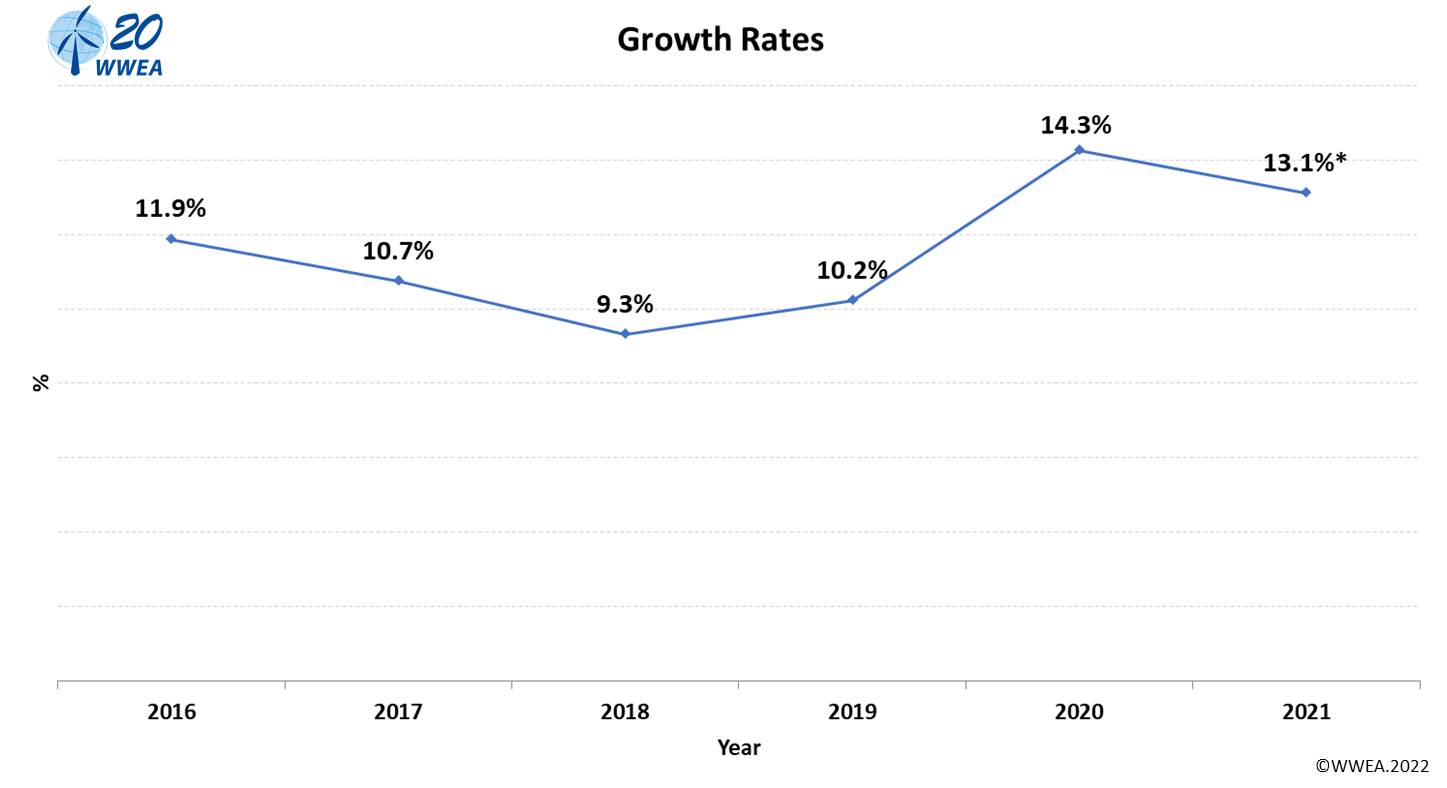

Bonn, 18 March 2022 (WWEA) – According to preliminary statistics published by WWEA today, the world market for wind turbines reached another record in 2021 with wind turbines with a total capacity of 97,5 Gigawatt installed around the globe, after 92,7 Gigawatt in 2020. The overall capacity of all wind turbines worldwide has now exceeded 840 Gigawatt (after 742,5 Gigawatt in 2020), enough to provide more than 7% of the global power demand.

This equals a growth rate of 13%, compared to 14% one year earlier and 10% in 2019.

According to preliminary figures from China, the country alone installed 55,8 Gigawatt in 2021, once again beating its own record of 2020 when 52 Gigawatt were installed. This is equivalent to a growth of 19,4%. China has now 344 Gigawatt of wind turbines installed across the country.

The US as the world’s number 2 market saw robust growth of 12,5 Gigawatt, although substantially less than in 2020 when almost 17 Gigawatt were added. The installed wind power capacity in the US is now close to 135 Gigawatt.

Brazil has turned out as the world’s third largest market for new wind turbines and showed 18,6% growth, adding 3,4 Gigawatt in one year. This makes the country the undisputed wind power leader in South America, with an overall wind power capacity of 21,4 Gigawatt.

The European markets show diverse developments: While the United Kingdom (2,6 Gigawatt) and Sweden (2,2 Gigawatt) achieved new installations of more than 2 Gigawatt and Germany slightly improved with 1,7 Gigawatt of net additions, although still far below 2017/2018, several European markets underperformed in 2021. Sweden entered the top ten wind markets as newcomer, with now 12 Gigawatt of overall wind capacity.

The second largest Asian wind power nation, India, reached a milestone of over 40 Gigawatt of total capacity, however, the country is behind its targets and added around 1,5 Gigawatt in the calendar year 2021. Ambitious national targets for wind power indicate that strong growth can be expected in the near future.

“Wind energy has continued to maintain major growth rates around the world.“ Peter Rae, President of World Wind Energy Association, said today. “The first publication of the 2021 wind industry Annual Statistics now being released by WWEA, show strong leadership in new installations by China followed in growth percentage by Brazil. Brazil’s outstanding growth has followed predictions made during the holding of our World Wind Energy Conference WWEC2019 in Rio de Janeiro.“ Mr Rae said congratulating Dr. Everaldo Feitosa, the Brazil Honorary Vice President of WWEA.

“The world needs pollution free clean energy supply and the wind industry continues to play a very strong role in achieving this growth notwithstanding the trade and general economic disruptions caused by the Covid 19 pandemic.“ Mr. Rae said. “China has maintained its leadership in new wind turbine deployment. This has included substantial development of offshore siting of wind farms as well as huge new land based wind. The Chinese Wind Energy Association, with its Honorary Chair and President Emeritus of the WWEA, He Dexin, as well as CWEA Secretary General and WWEA Vice President Qin Haiyan, continues to provide drive and assistance in that growth as does China’s leading manufacturer Goldwind with Wu Gang, its business head and former WWEA Vice President.”

WWEA Secretary General Stefan Gsänger: “The new record shows us what the wind industry is capable of achieving, even in pandemic times. The world is on its way to the age of renewables, and this development is even expected to be accelerated by the ongoing war in Ukraine. Governments and people around the world are shifting towards locally resourced, affordable renewable energy which ensures energy independence and peace.”

Country/Region

2024

New Capacity 2024

Growth Rates 2024

2023

2022

2021

China

570'000

99'370

21.1%

470'630

395'630

346'670

Germany

73'500

4'025

5.8%

69'475

66'242

63'924

Brazil

32'067

3'487

12.2%

28'580

23'661

21'567

Canada

24'147

7'161

42.2%

16'986

15'212

14'206

Sweden

17'219

968

6.0%

16'251

14'278

12'173

Italy

12'750

738

6.1%

12'012

11'647

11'322

Netherlands

11'500

485

4.4%

11'015

8'215

7'846

Finland

8'000

1'054

15.2%

6'946

5'677

3'256

Portugal

6'400

596

10.3%

5'804

5'730

5'612

Japan

6'200

986

18.9%

5'214

4'727

4'574

Rest of the World

20'019

0

0%

404'196

380'124

353'591

Total

781'802

0

-25.3%

1'047'109

931'143

844'740

Country/Region

2024

New Capacity 2024

Growth Rates 2024

2023

2022

2021

China

570'000

99'370

21.1%

470'630

395'630

346'670

Germany

73'500

4'025

5.8%

69'475

66'242

63'924

Brazil

32'067

3'487

12.2%

28'580

23'661

21'567

Canada

24'147

7'161

42.2%

16'986

15'212

14'206

Sweden

17'219

968

6.0%

16'251

14'278

12'173

Italy

12'750

738

6.1%

12'012

11'647

11'322

Netherlands

11'500

485

4.4%

11'015

8'215

7'846

Finland

8'000

1'054

15.2%

6'946

5'677

3'256

Portugal

6'400

596

10.3%

5'804

5'730

5'612

Japan

6'200

986

18.9%

5'214

4'727

4'574

Greece

5'550

324

6.2%

5'226

4'683

4'452

Argentina

3'995

290

7.8%

3'705

3'309

3'291

Austria

3'989

104

2.7%

3'885

3'572

3'291

Morocco

2'380

309

14.9%

2'071

1'455

1'437

Ukraine

2'100

199

10.5%

1'901

1'755

1'673

Uruguay

1'517

0

0.0%

1'517

1'517

1'517

Tunisia

243

0

0.0%

243

243

245

Mauritania

135

0

0.0%

135

34

34

Switzerland

100

0

0.0%

100

87

87

Algeria

10

0

0.0%

10

10

10

Rest of the World

0

0

0%

385'403

363'460

337'554

Total

781'802

0

-25.3%

1'047'109

931'143

844'740